GT's VERIZON WIRELESS CONNECTION TO THE INTERNET IS ABSOLUTELY HORRIBLE!

THE COMPANY MIS-REPRESENTED THE SERVICE, KNOWING FULL WELL, THAT THEY HAVE HAD OVER 30 COMPLAINTS ABOUT THE WEAK SIGNAL STRENGTH IN THIS AREA ONLY 25 MILES FROM A MAJOR CITY IN IDAHO, AND AN EVEN LARGER CITY, SPOKANE, IN WASHINGTON JUST 30 MILES AWAY WHERE THEIR SERVERS ARE LOCATED FOR THIS AREA.

THE TECH HELP PEOPLE, AND JUST ABOUT EVERYONE ELSE AT VERIZON ARE NOTHING BUT APOLOGIZING, DO NOTHING, ROBOTS.

THEY CARE NOTHING ABOUT THE CUSTOMER BUT SIGNING THEM UP FOR THEIR OVER PRICED SERVICES WHICH DON'T MEET EVEN THE LOWEST OF EXPECTATIONS.

THEY HAVE THE AUDACITY TO CHARGE US IN THIS KNOWN PROBLEM AREA THE SAME HIGH RATE AS THOSE IN THE MORE POPULATED, AND THUS MORE PROFITABLE FOR VERIZON, AREAS.

UNFORTUNATELY FOR NOW, I AM STUCK WITH THIS SERVICE AS EVEN A SATELLITE SERVICE HAS USAGE LIMITS THAT I WOULD EXCEED. I MAY EVEN EXCEED VERIZON'S LIMITS OF 5 GIGS AT THE USAGE RATE I AM SEEING IN JUST A FEW HOURS OF USING IT.

POSTING ANYTHING EVEN SLIGHTLY GRAPHICAL, LIKE MY CHARTS, TAKES FOREVER AND CONSUMES FAR TOO MUCH OF MY ALLOTED USAGE QUOTA SO I MAY NOT BE ABLE TO POST MUCH OF ANYTHING CHART WISE. I WILL HAVE TO WAIT A FEW WEEKS TO SEE WHAT MY USAGE AMOUNTS WILL BE.

AVOID VERIZON WIRELESS AT ALL COSTS.

IT IS ABSOLUTELY URGENT THAT YOU PURCHASE ALL THE PHYSICAL GOLD AND SILVER COINS YOU CAN AFFORD, RIGHT NOW,OR YOU WILL SUFFER GREATLY IN THE VERY NEAR TERM AND COULD POSSIBLY DIE IF YOU DON'T PROTECT YOUR REMAINING ASSETS IN THE ONLY TRUE MONEY ON EARTH.

Sunday, October 31, 2010

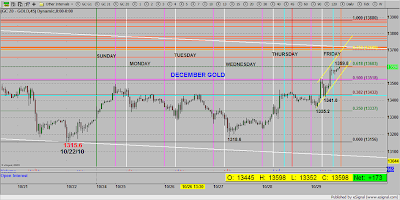

4:42 PM PDST GOLD MOVES HIGHER, PULLS BACK 75%, RALLIES BACK UP ALMOST 75%, AND IS NOW MOVING LOWER

THIS CHART TOOK A VERY LONG TIME TO POST AND I'M SURE CHEWED UP A LOT OF MY ALLOTTED USAGE QUOTA, SO POSTING MANY CHARTS IS NOT GOING TO BE PRACTICAL. I WILL POST SOME CHARTS THAT SHOW THE GENERAL TREND LINES AND FIBONACCI RETRACEMENT POINTS THAT ARE MOST IMPORTANT.

NOTICE: GT IS HAVING DIFFICULTY WITH THE DOWNLOAD SPEEDS USING VERIZON WIRELESS BUT THINGS ARE GETTING A BIT BETTER

THE DOWNLOAD SPEEDS ON VERIZON WIRELESS ARE PATHETIC. THEY CAUSE MY TRADING PLATFORM TO BE VERY SLOW WHEN I SWITCH BETWEEN TIME INTERVALS OR DIFFERENT CONTRACTS.

APPARENTLY MY TRADING PLATFORM IS 'REMEMBERING' MY CURRENT DATA AND SO IS SPEEDING UP THE CHANGING BETWEEN THE ABOVE MENTIONED DATA.

MY DATA USAGE WILL STILL BE AN ISSUE AND I DON'T WANT TO EXCEED THE 5 GIGS VERIZON HAS AS A LIMIT ON MY CONNECTION. OVER USAGE CAN GET USURIOUS.

CHARTS WILL BE POSTED AS I HAVE TIME AND THE MARKET SHOWS SIGNIFICANT CHANGES.

APPARENTLY MY TRADING PLATFORM IS 'REMEMBERING' MY CURRENT DATA AND SO IS SPEEDING UP THE CHANGING BETWEEN THE ABOVE MENTIONED DATA.

MY DATA USAGE WILL STILL BE AN ISSUE AND I DON'T WANT TO EXCEED THE 5 GIGS VERIZON HAS AS A LIMIT ON MY CONNECTION. OVER USAGE CAN GET USURIOUS.

CHARTS WILL BE POSTED AS I HAVE TIME AND THE MARKET SHOWS SIGNIFICANT CHANGES.

Friday, October 29, 2010

NOTICE: GT WILL BE POSTING CHARTS LESS FREQUENTLY STARTING SUNDAY OCT 31

AS EXPLAINED IN PREVIOUS POSTS, I AM CHANGING TO A WIRELESS INTERNET PROVIDER THAT HAS USAGE LIMITS OF 5 GIGABYTES WITHOUT EXTRA CHARGES.

I HAVE TO USE MY USAGE ALLOWANCE FOR MY OWN PERSONAL TRADING UNTIL I CAN SEE HOW MY USAGE STATISTICS TURN OUT FOR NOVEMBER.

I WILL DO MY BEST TO POST IMPORTANT CHARTS AT CRITICAL TRADING POINTS DURING THE CRIMEX SESSION AND OVERNIGHT.

ALL YOU HAVE TO DO IS REFRESH THE BLOG PAGE TO SEE THE LATEST CHARTS.

I HAVE TO USE MY USAGE ALLOWANCE FOR MY OWN PERSONAL TRADING UNTIL I CAN SEE HOW MY USAGE STATISTICS TURN OUT FOR NOVEMBER.

I WILL DO MY BEST TO POST IMPORTANT CHARTS AT CRITICAL TRADING POINTS DURING THE CRIMEX SESSION AND OVERNIGHT.

ALL YOU HAVE TO DO IS REFRESH THE BLOG PAGE TO SEE THE LATEST CHARTS.

RED DOWN FLAG WITHIN THE WHITE DOWNTREND CHANNEL/FLAG SHOULD RESOLVE HIGHER

AHEAD OF THE WEEKEND, THE LAST TRADING DAY OF OCT, AND THE ELECTION NEXT WEEK, HARD TO SAY WHAT GOLD TRADERS WILL WANT TO DO. LOGIC SAYS BE LONG GOLD ALL THE TIME TO BE ABLE TO PARTICIPATE IN THE 'GUARANTEED' BREAK OUT HIGHER THAT IS COMING EVENTUALLY

GOLD RALLIES 75% THEN FALLS

GOLD MAY BECOME MORE ACTIVE WHEN STOCKS OPEN. RIGHT NOW GOLD IS DROPPING FAST TO THE 75% RETRACE POINT

GOLD COULD SPIKE UP TO 1370 AS SHOWN IN YELLOW

TWO LARGE VOLUME MOVES ALREADY BEFORE THE OPEN, LIKELY THE B BANKS ARE ALREADY POUNDING THE PRICE TO KEEP IT FROM SPIKEING, BUT IF THE SHORTS PANIC AND COVER, THE PRICE WILL SHOOT HIGHER AND WE ARE ON OUR WAY TO 1400 PLUS

Thursday, October 28, 2010

DAN NORCINI'S THURSDAY COMMENTS WITH GOLD CHART

Posted: Oct 28 2010 By: Dan Norcini Post Edited: October 28, 2010 at 1:57 pm

Filed under: Trader Dan Norcini

Filed under: Trader Dan Norcini

Dear CIGAs,

If yesterday was “the Fed is going to take our expected punch bowl away from us” day, today was, “the Fed is going to not only bring the punch bowl, but spike it with white lightning”. Word from a Bloomberg story that the Fed is consulting with the primary dealers was enough to dispel the doubts from yesterday. “She loves me; she loves me not; she loves me; she loves me not”. And thus the waiting game goes on…

.

Seriously, the markets are moving back and forth based on the changing expectations and psyche of the speculative trading community. Expect this to continue until we get more definitive amounts when the FOMC makes it announcement next week. The phrase of this week, and until then, is “range trade”.

Gold bounced from $1320 on the bottom of the range and is running towards $1,350 at the top of the range. To repeat myself ad infinitum, ad nauseum, a break out of this range on decent volume that closes either above $1,350 or below $1,320 on two consecutive trading days, will give us the direction of the next trend. The reason – The Dollar will either rise or fall depending on that announcement next week. Make no mistake – QE is coming. The only question is the amount and the timing.

The Dollar was of course beaten with an ugly stick today as the giddiness surrounding the Bloomberg story motivated Forex traders to unload on it. That it has fallen so sharply is evidence of the dangers inherent in the Fed’s policy. As I said yesterday, the Fed can either save the Dollar or the stock market; they cannot do both.

The HUI bounced off the bottom of its range, following the metals, and moved back towards 520. Until it takes that out and follows through, it will be trapped in a consolidation mode.

Wheat is slowly grinding higher on dryness fears in the winter wheat growing areas here in the US. The entire grain complex continues to experience supply concerns which is working to push food prices inexorably higher, notwithstanding the load of BS being dished out by the official government agencies that tell us food inflation is tame. I guess they think that we are too damn dumb to believe our own eyes. Corn is slowly closing in on the $6.00 mark while wheat is back above $7.00. Soybeans are over $12.

If that were not enough, Sugar is now up near $0.30 pound, an incredible price. Coffee, while weaker today, is at levels last seen in September 1997! Nope – no rising food costs anywhere in sight….

Once again the saving grace for the beleaguered consumer is the energy sector, especially natural gas, which is mired in an oversupply glut that has kept it subdued for some time now. Crude oil also cannot seem to get much going as it struggles with the region near $83 – $84. Until it can push past there, consumers will be able to enjoy relatively cheaper energy costs even as they dig deeper into their wallets for grocery money.

Bonds remain rather lackluster. They are however perched rather precariously above an important chart support level near 129 ^10. If they are going to bounce and move back within the rather broad range they have carved out over the last two months, they had better do so quickly or we could see them drop towards 126. At some point the multi decade bull market in bonds is going to come to a rather inglorious end but I am not ready to make that call just yet; not with the probability of massive Fed buying of Treasuries waiting in the wings. At least they are buying them because if the Dollar drops through 77 and especially 76, no one else is going to want them.

Until we get past next week’s FOMC announcement and the upcoming election, there really isn’t a whole lot more worth saying.

DAN'S CHART:

http://jsmineset.com/wp-content/uploads/2010/10/October2810Gold.pdf

If yesterday was “the Fed is going to take our expected punch bowl away from us” day, today was, “the Fed is going to not only bring the punch bowl, but spike it with white lightning”. Word from a Bloomberg story that the Fed is consulting with the primary dealers was enough to dispel the doubts from yesterday. “She loves me; she loves me not; she loves me; she loves me not”. And thus the waiting game goes on…

.

Seriously, the markets are moving back and forth based on the changing expectations and psyche of the speculative trading community. Expect this to continue until we get more definitive amounts when the FOMC makes it announcement next week. The phrase of this week, and until then, is “range trade”.

Gold bounced from $1320 on the bottom of the range and is running towards $1,350 at the top of the range. To repeat myself ad infinitum, ad nauseum, a break out of this range on decent volume that closes either above $1,350 or below $1,320 on two consecutive trading days, will give us the direction of the next trend. The reason – The Dollar will either rise or fall depending on that announcement next week. Make no mistake – QE is coming. The only question is the amount and the timing.

The Dollar was of course beaten with an ugly stick today as the giddiness surrounding the Bloomberg story motivated Forex traders to unload on it. That it has fallen so sharply is evidence of the dangers inherent in the Fed’s policy. As I said yesterday, the Fed can either save the Dollar or the stock market; they cannot do both.

The HUI bounced off the bottom of its range, following the metals, and moved back towards 520. Until it takes that out and follows through, it will be trapped in a consolidation mode.

Wheat is slowly grinding higher on dryness fears in the winter wheat growing areas here in the US. The entire grain complex continues to experience supply concerns which is working to push food prices inexorably higher, notwithstanding the load of BS being dished out by the official government agencies that tell us food inflation is tame. I guess they think that we are too damn dumb to believe our own eyes. Corn is slowly closing in on the $6.00 mark while wheat is back above $7.00. Soybeans are over $12.

If that were not enough, Sugar is now up near $0.30 pound, an incredible price. Coffee, while weaker today, is at levels last seen in September 1997! Nope – no rising food costs anywhere in sight….

Once again the saving grace for the beleaguered consumer is the energy sector, especially natural gas, which is mired in an oversupply glut that has kept it subdued for some time now. Crude oil also cannot seem to get much going as it struggles with the region near $83 – $84. Until it can push past there, consumers will be able to enjoy relatively cheaper energy costs even as they dig deeper into their wallets for grocery money.

Bonds remain rather lackluster. They are however perched rather precariously above an important chart support level near 129 ^10. If they are going to bounce and move back within the rather broad range they have carved out over the last two months, they had better do so quickly or we could see them drop towards 126. At some point the multi decade bull market in bonds is going to come to a rather inglorious end but I am not ready to make that call just yet; not with the probability of massive Fed buying of Treasuries waiting in the wings. At least they are buying them because if the Dollar drops through 77 and especially 76, no one else is going to want them.

Until we get past next week’s FOMC announcement and the upcoming election, there really isn’t a whole lot more worth saying.

DAN'S CHART:

http://jsmineset.com/wp-content/uploads/2010/10/October2810Gold.pdf

THE CURRENT SMALL BLUE DOWN FLAG WHICH SHOULD RESOLVE UP IS WITHIN THE CONTEXT OF THE MUCH LARGER WHITE DOWNTREND CHANNEL/FLAG WHICH WILL ALSO RESOLVE HIGHER...MUCH HIGHER AND SOON!

GOLD IS CURRENTLY TRADING IN A RANGE BETWEEN 1320 AND 1350 WHICH COULD CONTINUE FOR AWHILE AND IS A GOOD RANGE FOR TRADERS. JUST DON'T GET CAUGHT SHORTING GOLD, BECAUSE WHEN IT SPIKES, IT WILL WIPE YOU OUT! ONLY TRADE THE LONG SIDE OF GOLD IF YOU HAVE ANY WORKING BRAINS!

Subscribe to:

Posts (Atom)